The Changing Leadership Requirements of Financial Leaders

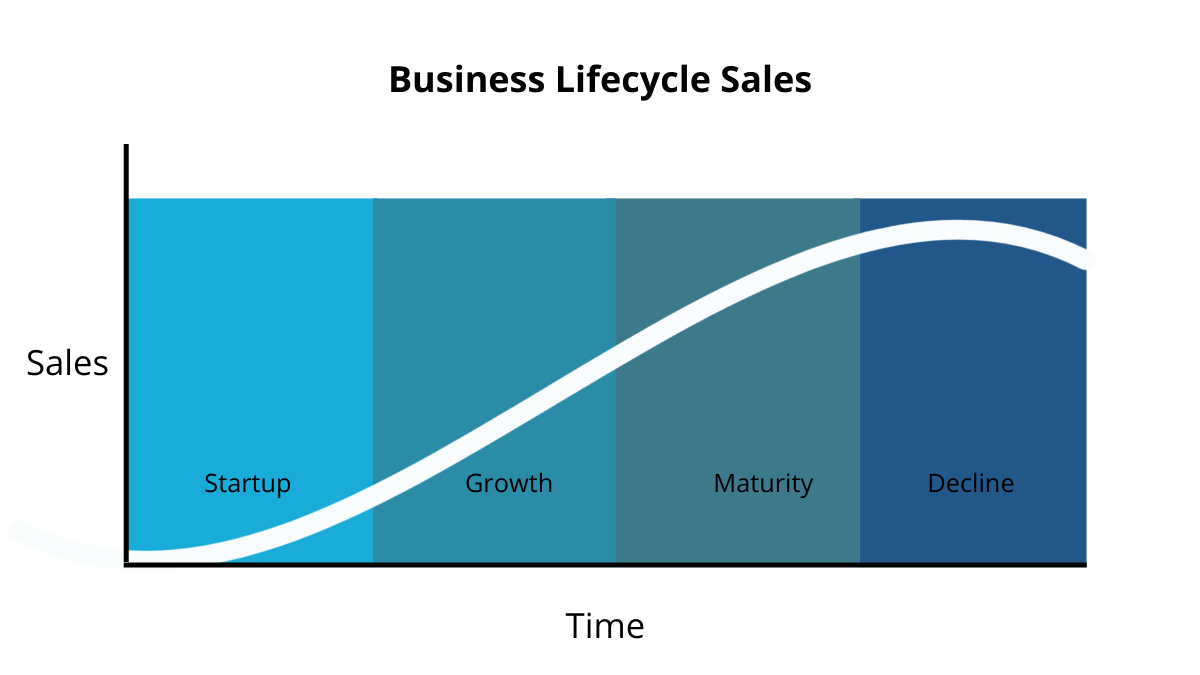

According to global statistics, there were more than 1.35M cleantech start-ups in 2021 globally, and that number is set to increase in 2022 (1). As a business, Gibson Watts collaborates with a myriad of different organisations, including start-ups. These companies are at various stages in their business lifecycle (see figure 1). Depending on the stage of the company, depends exactly on their needs from a Chief Financial Officer (CFO).

(Figure 1)

(Figure 1)

The role of the CFO is evolving rapidly, changing in line with the needs of businesses. Clients require more from their lead Financier than ever before. Businesses no longer simply need their lead financial officer to report or manage the numbers, but instead they now expect these individuals to demonstrably contribute to the success, and strategy of the organisation.

According to Deloitte, in their latest CFO insights survey (2), the most desirable skills for a CFO are operational finance, strategy creation and communication. These skills are required for partnering with the CEO to evaluate and develop strategy, contributing to business leadership. The subjective requirements of a CFO have also increased, with expectations of cross-functional influencing capabilities, and the capacity to coach and develop those around them. The responsibilities of the CFO have been growing year-on-year, where they may now be accountable for Investor Relations, Mergers & Acquisitions, Board Engagement as well as Procurement and Digital (3).

(Source: Deloitte)

Given the ever-increasing expectations and demands placed on a CFO, here at Gibson Watts, we made sure that we understood the full picture of what our clients needed in their new CFO. Thus, ensuring the recruitment of this new individual encompassed all expectations they had, and the successful candidate clearly understood the task at hand for the next 3-5years. In most instances, the business required help raising capital, either to fund continued growth, future developments or to launch an acquisition pipeline.

At Gibson Watts we focus on supporting clients across the Cleantech sector, which not only has a 2.1% share of all new start-ups across North America in 2021 (4) but is also expected to grow dramatically from $283bn in 2020 to $423bn in 2026 (5). Given a CFO’s focus on the kind of value creation that relies on their deep understanding of the economics of a company’s business model, their strategic perspective on sector-shaping trends, and their role as thought partners with the CEO and the Board, they are best qualified to drive change and enable success.

By now, we have come to realise that a CFO, or at least a highly skilled one, is more than just a ‘bean counter.’ It is imperative that a CFO is recruited at the right time for the business, too soon and the individual will not be challenged, too late, and the company may have missed its best chance for growth. The CFO can help a start-up company to build a strong foundation that will support the business as it grows, and that growth can sometimes happen almost overnight.

Final Thoughts

When working with start-up businesses at the beginning of their journey that need to continuously raise significant finance, not just through a single event, such as an Initial Public Offering (IPO), we have been directing clients towards the investment banking community. Individuals with 10-20 years’ experience, who ‘have seen it all'; they have sat next to the CEO and discretely advised, they sit on numerous Boards, have completed successful IPOs and have throughout their career, successfully developed a narrative to raise significant capital for numerous organisations. Investment Bankers have all the necessary skills that a business in this position may need in its next CFO. In some instances, by years 10-20, they have also spent enough time in the Banking sector that they are keen to make a move into industry, where they can play a pivotal role contributing towards the success of a company.

CFOs are necessary for raising capital, , provide guidance and structure to the process, bringing comfort to investors that the company has fiscal responsibility to. While investors invest in founders, CEOs and their management teams, a great CFO can shorten the time to raise capital, make sure the investors are the right fit, and get the best price and terms for the equity. At their best they contribute far more than just financial acumen to the success of organisations.

If you need any assistance with the acquisition of a CFO, please contact a member of our team today, to see how we can help.

Written by Josh Smith, Head of Executive Search Gibson Watts.

- https://www.statista.com/topics/4733/startups-worldwide/#topicHeader__wrapper

- https://www2.deloitte.com/us/en/pages/finance/articles/the-cfo-agenda.html

- https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/mastering-change-the-new-cfo-mandate

- https://firstsiteguide.com/startup-stats/

- https://www.globenewswire.com/news-release/2021/08/10/2277874/0/en/Global-Clean-Energy-Technologies-Market-Size-Expected-to-Grow-to-USD-423-7-Billion-by-2026-Facts-Factors.html